Vision

To be the best team at driving the future development of CX, we seek to enable our clients, through a human-centered approach, to achieve sustainable business growth and become inclusive organizations where people learn, connect, and play.

Latest Topics

Observations from the Field: Cashless Payment in Thailand and China

- Culture

- Field observation

- Payment

With the easing of travel restrictions globally, some mct members embarked on exploratory journeys in countries outside of Japan, hoping to get a clearer sense of the most up-to-date trends and insights from the destination countries.

Sonoka, who is native Japanese, chose to go to Thailand and immersed herself in the local life as a digital nomad for several months, hoping to rediscover South East Asia. Wenxin, born in China, went back to her homeland after almost four years’ absence, curious to see new changes happening in the country. After both returned to Japan earlier this summer, Sonoka and Wenxin met to share their experiences and ideas. One mutual topic that emerged was the state of cashless payments, especially mobile payment methods, in Thailand and China.

Widespread QR Code

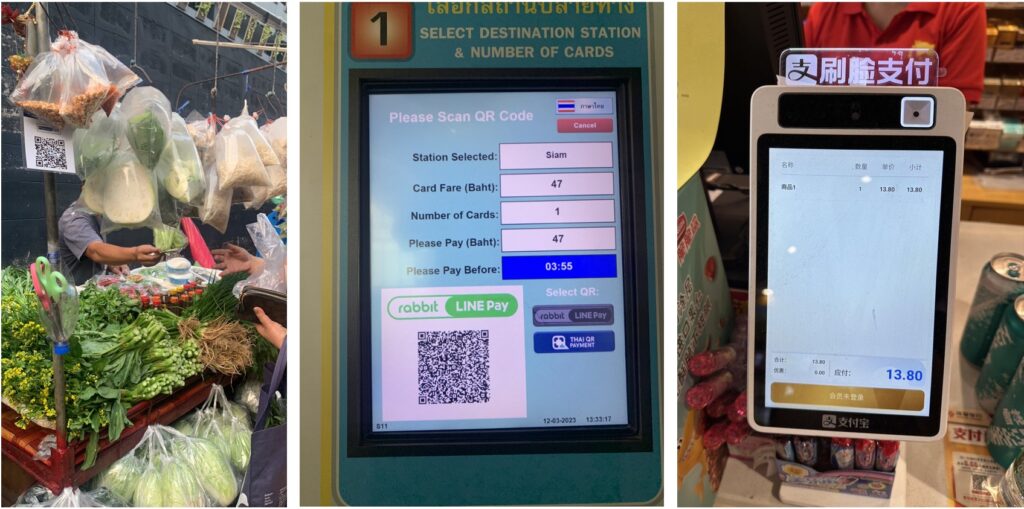

Even with cash remaining essential in Thailand, “scanning the QR code to pay” is gaining a lot of presence in Thailand, with many small food/groceries stalls even welcoming the QR code. Despite the increasing number of people using mobile payment apps to pay in some scenarios such as metro stations, there are still a decent number of people who insist on using cash even when mobile payment is accepted. In the picture below on the left, the QR code is available to scan but many buyers still choose to pay cash at the vegetable vendor. In the picture below in the middle, the QR code to buy tickets at the station is much more prominent. There is another machine accepting cash but seems less used. Therefore, in Thailand, it seems that the mobile payment services are widely provided, but the use of cash is still one of the main payment behaviors.

In China, which has been the leading force in cashless payment for many years now, the adoption of mobile payment has been so prevalent that even a vegetable market in a rural township wants you to scan the QR code. Chinese citizens also get used to scanning the QR code using their smartphones. You barely see people use cash in the supermarkets or coffee shops on the street except for the elderly who do not have smartphones.

In the meantime, the cashless payment ecosystem in China has moved beyond QR code scanning to biometric authentication methods such as face-scanning payment (as shown in the picture below on the right) and the newly launched palm-scanning payment services. In the picture below, neither wallet nor mobile phone is needed if the face is recognized by the system, and it directly connects the payment account you have set up before. Therefore, in China, with mobile payment being widely accepted and used, new different types of cashless payments have been explored in order to bring more convenience to users.

Interesting-to-Discover Business Transformation Powered by Mobile Payment

Shared between Sonoka and Wenxin was the observation of the transformation of business activities happening in both Thailand and China, especially the shift from offline to online business including well-known retail (e.g., Ecommerce) and food (e.g., food delivery) industry, and some other interesting-to-discover business activities.

For example, in the first picture below, a donation box in Thailand now accepts donations through scanning the QR code. Meanwhile, a mobile payment enabled toilet paper dispenser in China, as shown in the second picture below, could help you save the trouble of rushing to convenience stores or other shops to buy the tissue if you do not have some with you. Usually, the public toilets in China do not provide toilet paper so it has become a habit for Chinese to carry tissues with them. However, this type of dispenser allows you to get the free toilet paper by scanning the QR code. But it also gets some complaints from users who are in a hurry because it takes more time than they expected to complete all the procedures before getting the toilet paper.

As shown in the third picture below, buying lottery tickets from a machine is available in some of the shopping malls in China. People used to go to a lottery booth to buy lottery tickets, but now with the lottery ticket machine, everything can be done from a touch screen and smartphone except that you still need to scratch off the coating on the lottery tickets by yourself to see if you have won a prize.

Additionally, in Shanghai, “ordering at your desk” is also becoming quite common as you can see in the fourth picture below. If you go to a restaurant by yourself, you can go directly to the table, take out your phone to scan the QR code on the table, order and pay. Some restaurants allow you to pay later while some ask you to pay immediately (but you can order multiple times). This certainly saves the lineup time for either ordering or checking out but sometimes the ordering process may not go smoothly, and you still need to find a staff member if you need more details regarding the dish, recommendations on what to order or some instructions on how to pay if this is the first time for you to order this way.

Overall, cashless payment, especially mobile payment, has certainly developed a lot in Thailand with growing attention. In China, it has pushed the boundaries of business scenarios with a high percentage of adoption in a society that remains quite techno optimistic. However, what is worth remembering is that some people do not have smartphones, are not able to use smartphones, do not have access to mobile payment systems, or simply refuse to use mobile payments. These cases may affect where and how mobile & cashless systems replace traditional methods. Therefore, how to address their needs in the fast-changing society should also be carefully considered.